UniversalToken

Fund Issuer smart contract description

Objective

The purpose of the contract is to allow perform a fund issuance on-chain.

How does it work?

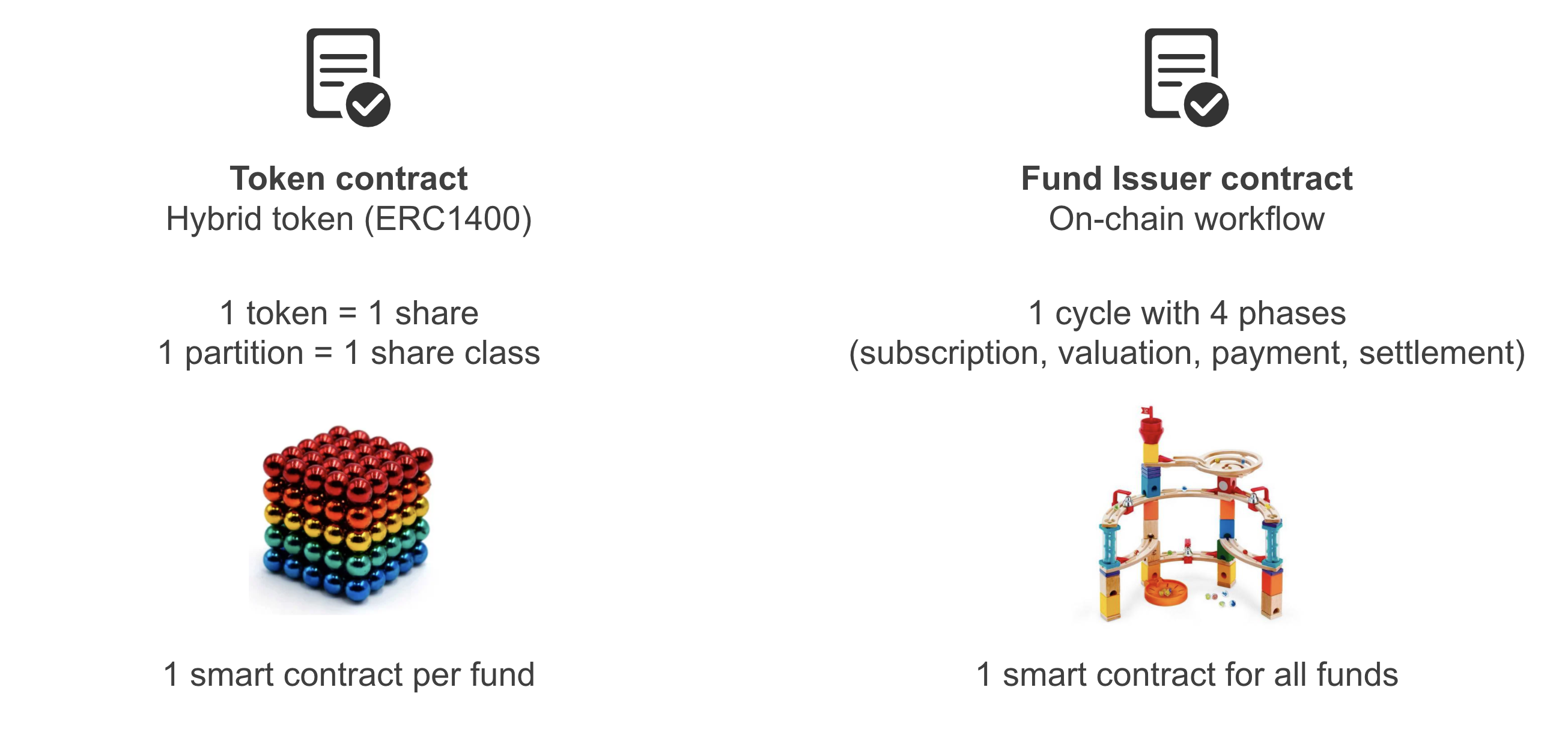

In order to perform a fund issuance on-chain, the following contracts are needed:

- A hybrid token contract (1 token = 1 share; 1 partition = 1 share class)

- A FundIssuer contract, which can be seen as the pipeline steering the token distribution

The steps to create a fund are the following:

- Prerequisite: ensure a FundIssuer smart contract is deployed on the network. If not, deploy one.

- Deploy the token contract (ERC1400)

- Set the the FundIssuer contract as: - Minter: in order to allow him to mint tokens (/addMinter method) - Certificate signer: in order to allow him to manipulate tokens without requiring certificates (/setCertificateSigner method)

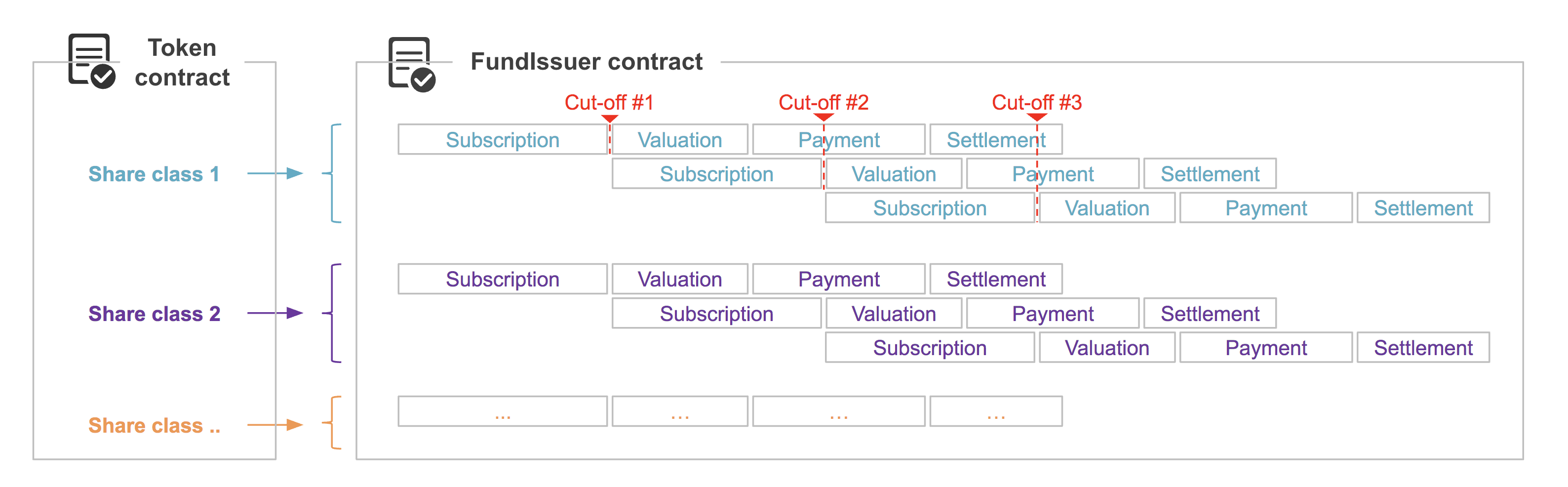

- For each share class: - Launch issuance cycles in the FundIssuer contract (/setAssetRules method)

An issuance cycle consists in 4 periods:

- Subscription: investors can subscribe by creating an order in the FundIssuer contract

- Valuation: Once cut-off is past (end of subscription period), the NAV (net asset value) is set by the issuer in the smart contract

- Payment: Investors pay for their order

- Settlement: Issuers settle the orders, thus issuing tokens for the investors

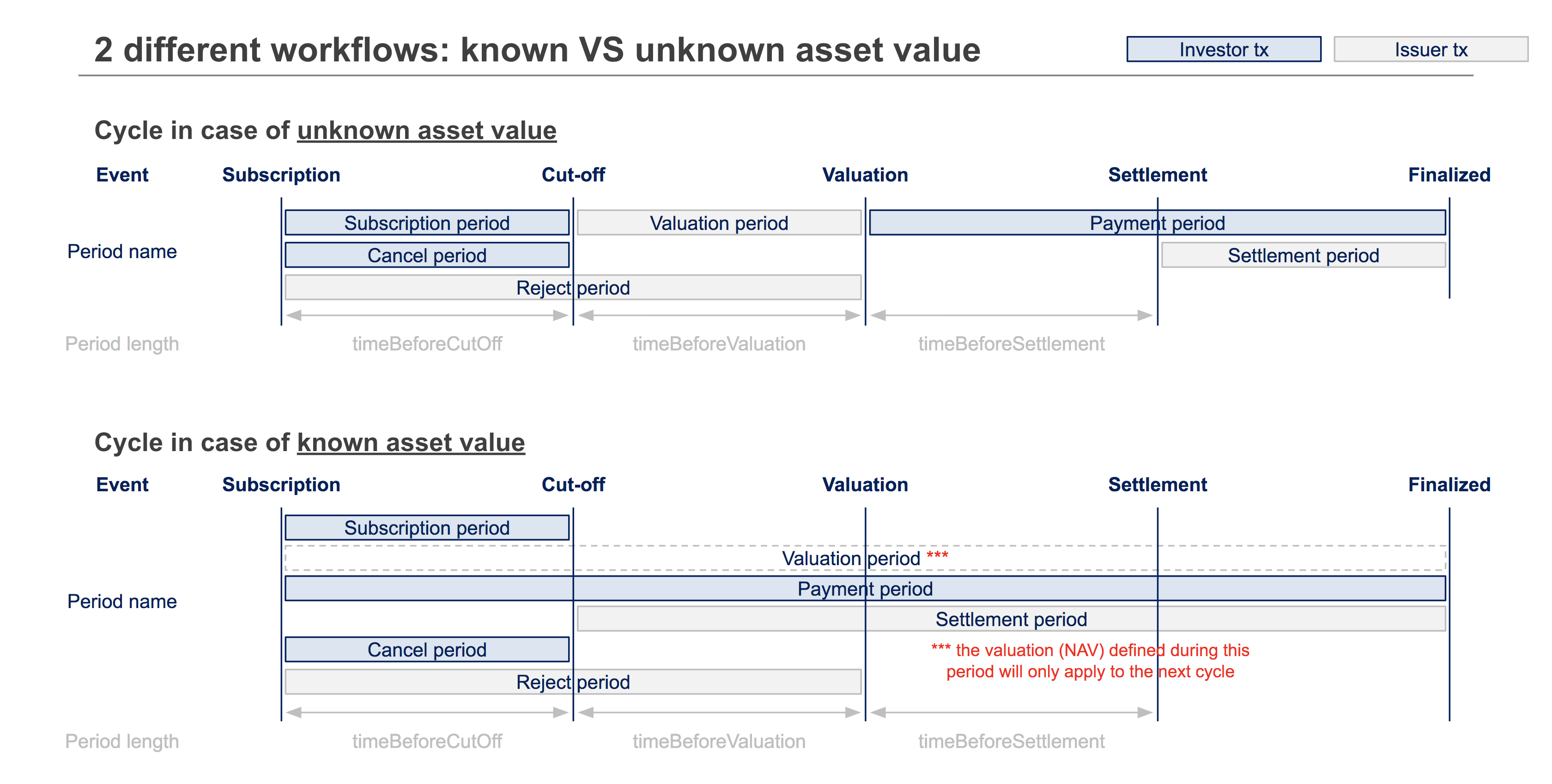

The FundIssuer smart contract covers 2 different use cases:

- Unknown asset value (NAV): the asset value needs to be injected in the smart contract at every valuation period, by a “Price Oracle”. Investors need to wait until the end of the valuation period before paying for their order.

- Known asset value (NAV): the asset value is already known at the beginning of the cycle. This allows investors to pay at the same time as they subscribe.