UniversalToken

Certificate-based token transfers

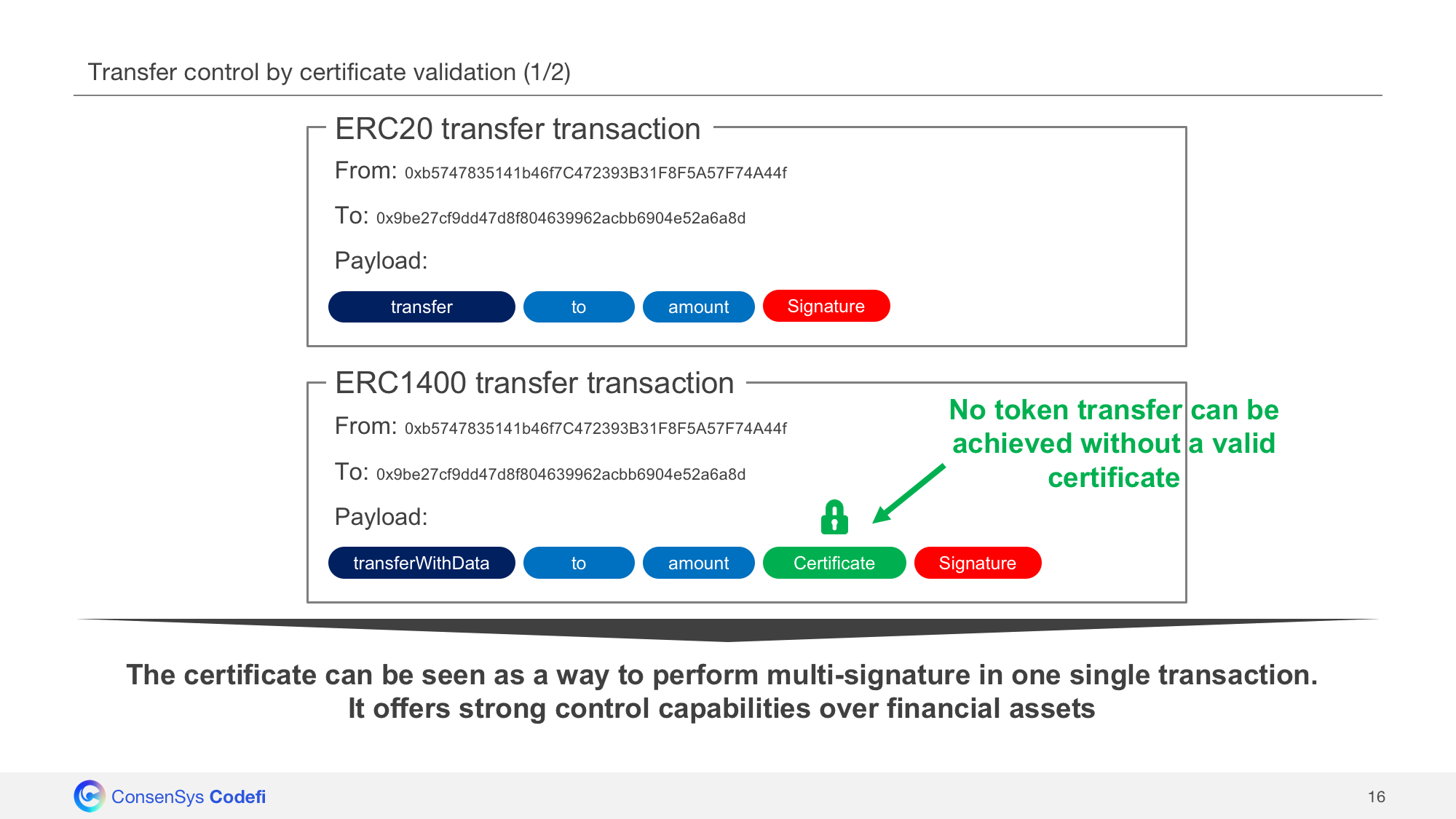

ERC1400 introduces additional features to ERC20 features, and provides issuers with strong control capabilities over their financial assets.

Introduction - The limits of ERC20 token standard

Currently the most common and well-known standard within crypto community is the ERC20(eips.ethereum.org/EIPS/eip-20). The vast majority of ICOs are based on this ERC20 standard, but it doesn’t appear to be the most relevant standard for financial asset tokenization. The only parameters required to perform an ERC20 token transfer are the recipient’s address and the value of the transfer, thus limiting the control possibilities over transfers:

function transfer(address recipient, uint256 value)

All controls have to be hard-coded on-chain and are often limited to simple/binary checks e.g. checking whether an investor is blacklisted or not.

Codefi Assets makes use of more evolved/granular controls to secure transfers. Those controls can evolve quickly and require flexibility, which makes it difficult to hard-code them on-chain.

Transfer controls based on certificates - A way to perform multisignature in one single transaction

The use of an additional ‘data’ parameter in the transfer functions can enable more evolved/granular controls:

function transferWithData(address recipient, uint256 value, bytes data)

Codefi Assets fosters to use this additional ‘data’ field, available in the ERC1400 standard, in order to inject a certificate generated off-chain by the issuer. A token transfer shall be conditioned to the validity of the certificate, thus offering the issuer with strong control capabilities over its financial assets.

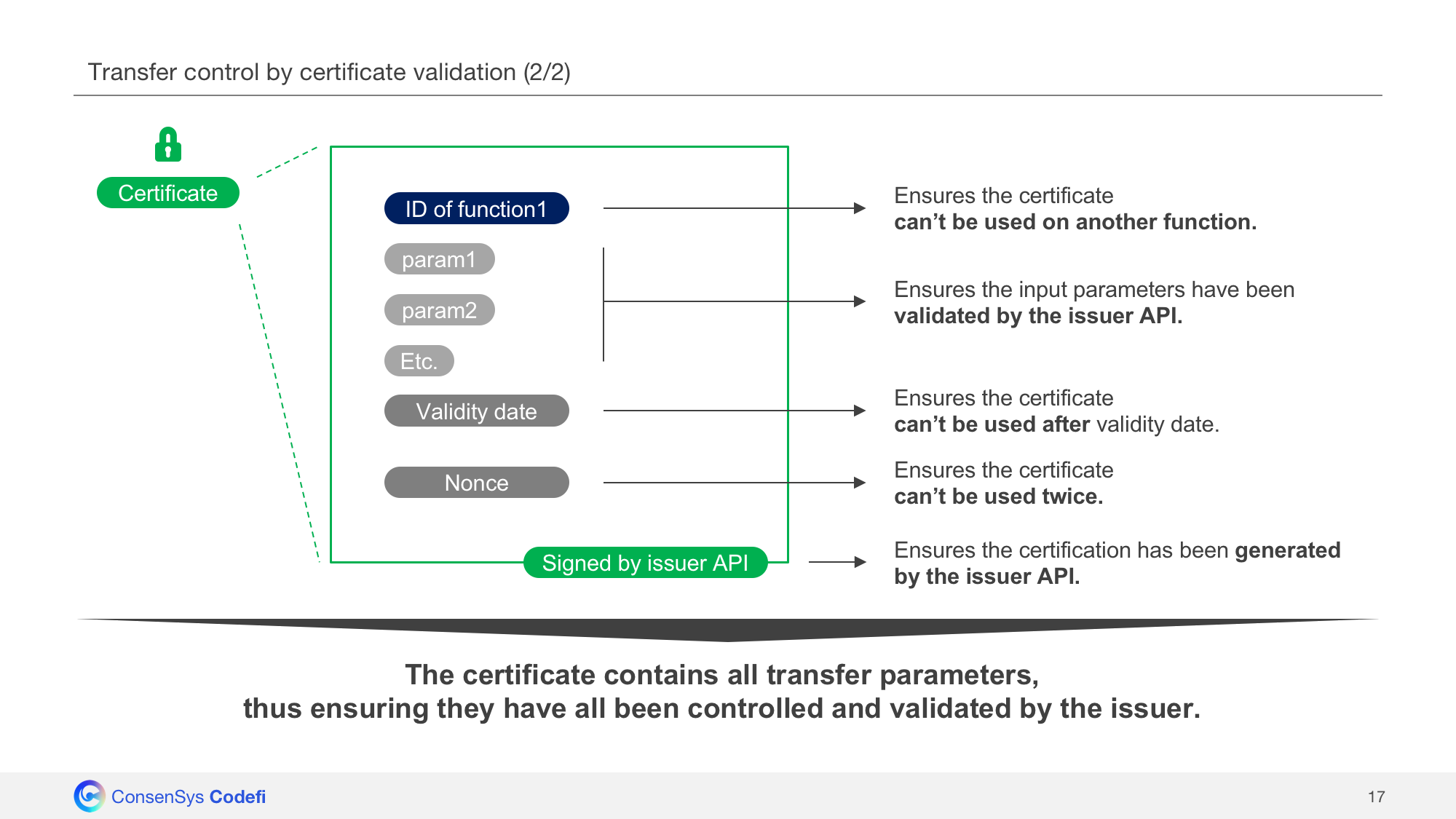

The Codefi certificate contains:

- The function ID which ensures the certificate can’t be used on an other function.

- The parameters which ensures the input parameters have been validated by the issuer.

- A validity date which ensures the certificate can’t be used after validity date.

- A nonce which ensures the certificate can’t be used twice.

Finally the certificate is signed by the issuer which ensures it is authentic.

The certificate enables the issuer to perform advanced conditional ownership, since he needs to be aware of all parameters of a transaction before generating the associated certificate.

In a way, this can be seen as a way to perform multisignature in one single transaction since every asset transfer requires:

- A valid transaction signature (signed by the investor)

- A valid certificate signature (signed by the issuer)

### Example use case

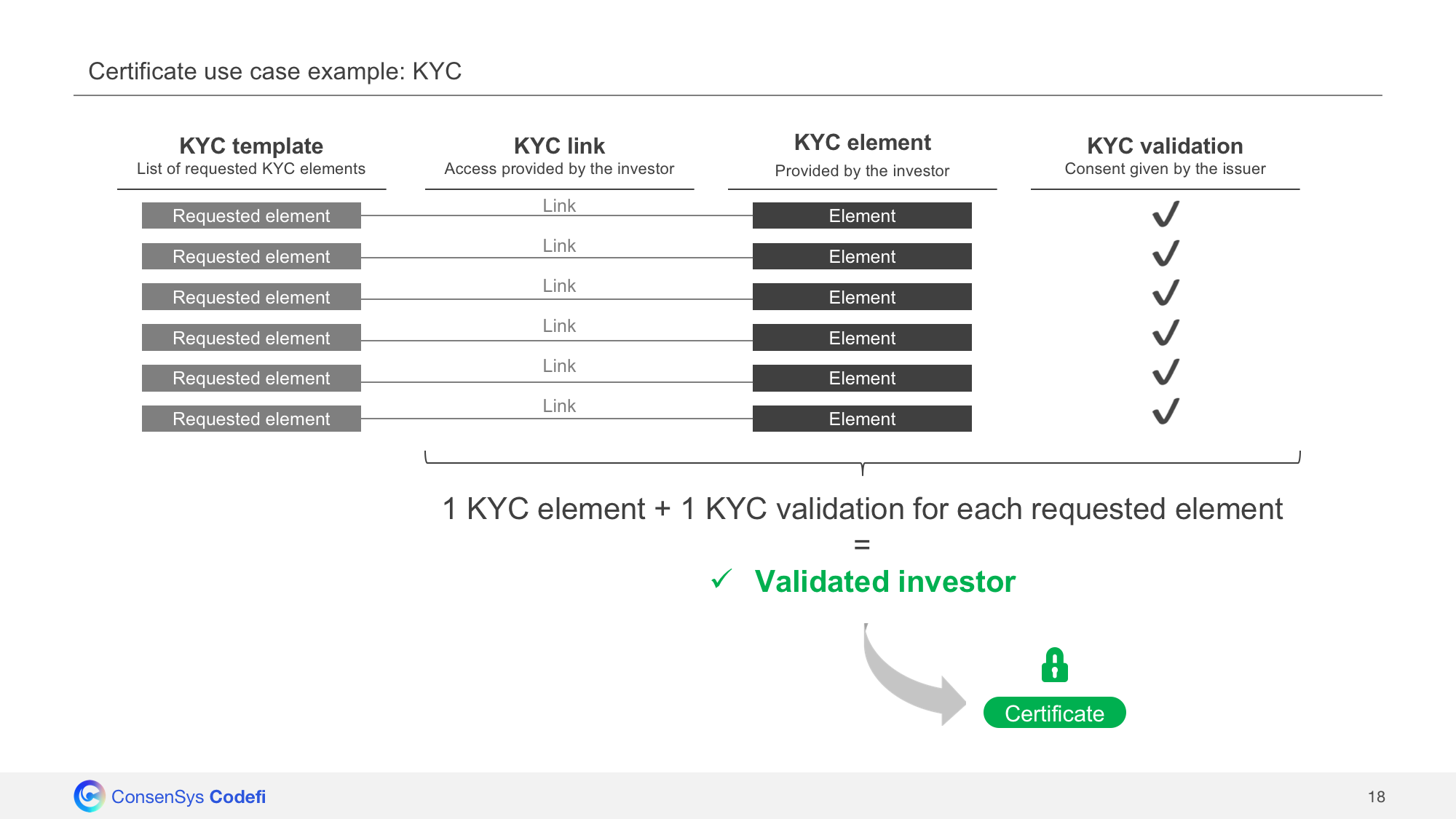

An example use case for the certificate validation is KYC verification.

The certificate generator can be coupled to a KYC API, and only provide certificates to users who’ve completed their KYC verification before.

PS: Since the ERC1400 standard is agnostic about the way to control certificate, we didn’t include our certificate controller in this repository (a mock is used instead). In order to perform real advanced conditional ownership, a certificate controller called ‘CertificateController.sol’ shall be placed in folder ‘/contracts/CertificateController’ instead of the mock placed there.

Description of certificate controllers and implementation choice (nonce vs salt)

The certificate controller, a way to perform multi-signature in a single transaction

Certificate controllers can be used by any smart contract requiring the verification of an approval generated off-chain. In the frame of Codefi Assets, the certificate controller is used by the ERC1400 token contract, to ensure, the token transfer requested by an investor, is indeed approved by the issuer.

The certificate controller performs an ec-recover operation on the provided certificate, in order to recover the signature of the certificate signer. The signature, which in the frame of Codefi Assets usually is the issuer’s signature, is then compared the list of signatures authorized by the contract.

In a way, it can be seen as a way to perform multi-signature, with one single transaction instead of two: every transaction contains both the signature of the investor (transaction signature) AND the signature of the issuer (certificate signature).

How to use the certificate controller?

The smart contract which requires to verify certificates needs to:

- Inherit from the certificate controller

- Add a

dataparameter in final position for the functions which require a certificate validation - Add a modifier

isValidCertificate(data)to the functions which require a certificate validation

An off-chain certificate generator module is of course required to create the certificates (it is not part of this repo).

Nonce-based VS Salt based certificate controllers

There are 2 ways to ensure a certificate can’t be used twice:

- Either introduce a local nonce for each user which is incremented by 1 every time a certificate is used

- Either introduce a salt generated randomly which is stored in mapping every time a certificate is used

The advantage of the nonce-based certificate, is it enables the issuer to control the order in which the transactions can be validated by the network. But this advantage can also be a problem, in the case when the issuer generates a batch of certificates for the investor without knowing the order they will be sent to the network. In this specific case of certificate batches, it is more relevant to use the salt based certificate.

Warning

Description

The certificate controllers (CertificateControllerNonce and CertificateControllerSalt) are used by passing a signature as a final argument in a function call. This signature is over the other arguments to the function. Specifically, the signature must match the call data that precedes the signature.

The way this is implemented assumes standard ABI encoding of parameters, but there’s actually some room for manipulation by a malicious user. This manipulation can allow the user to change some of the call data without invalidating the signature.

The following code is from CertificateControllerNonce, but similar logic applies to CertificateControllerSalt:

code2/contracts/CertificateControllerNonce.sol:L127-L134

bytes memory payload;

assembly {

let payloadsize := sub(calldatasize, 160)

payload := mload(0x40) // allocate new memory

mstore(0x40, add(payload, and(add(add(payloadsize, 0x20), 0x1f), not(0x1f)))) // boolean trick for padding to 0x40

mstore(payload, payloadsize) // set length

calldatacopy(add(add(payload, 0x20), 4), 4, sub(payloadsize, 4))

Here the signature is over all call data except the final 160 bytes. 160 bytes makes sense because the byte array is length 97, and it’s preceded by a 32-byte size. This is a total of 129 bytes, and typical ABI encoded pads this to the next multiple of 32, which is 160.

If an attacker does not pad their arguments, they can use just 129 bytes for the signature or even 128 bytes if the v value happens to be 0. This means that when checking the signature, not only will the signature be excluded, but also the 31 or 32 bytes that come before the signature. This means the attacker can call a function with a different final argument than the one that was signed.

That final argument is, in many cases, the number of tokens to transfer, redeem, or issue.

Mitigating factors

For this to be exploitable, the attacker has to be able to obtain a signature over shortened call data.

If the signer accepts raw arguments and does its own ABI encoding with standard padding, then there’s likely no opportunity for an attacker to exploit this vulnerability. (They can shorten the call data length when they make the function call later, but the signature won’t match.)

Remediation

This potential vulnerability can be addressed at the signing layer (off chain) by doing the ABI encoding there and denying an attacker the opportunity to construct their own call data.